With the end of summer arrival, it is high time to evaluate your financial position and strategize to close the summer on an uplifted note. Budgeting can also assist you to become financially stable and successful.

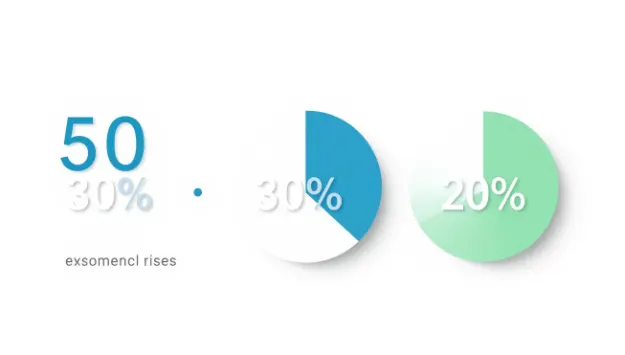

The 50:30:20 rule can help you use your income in a smart way so that you save enough to spend money on the present and the future. This is an easy to follow rule but has the potential to change the game in the financial planning process.

There is also another style of budgeting that is becoming increasingly popular and that is loud budgeting, which is where people become more open about their budget, their financial aspirations, and their financial priorities. With these strategies in place, you could have charge of your own finances and get closer to a more secure financial future.

Key Takeaways

- You can use the 50:30:20 rule to divide your income properly.

- The noisy budgeting helps people to be more vocal about their money ambitions.

- A mix of these strategies can bring about financial prosperity and success.

- Budgeting is essential in order to become financially secure.

- To move forward, it is important to measure your financial health on a regular basis.

Summer Money Challenge: Why Personal Finance Is Important Now.

The spirit of summer does not necessarily imply abandoning all caution on the altar of personal finance. With the warmer weather making inroads, it is important to recognize the financial pressures it brings with it.

Traps and Temptations of Summer Spending.

During summer, vacations, outside events, and socializing can become expensive. Common traps include:

- Last minute vacation bookings.

- Summer sales impulse purchases.

- Dining out frequently

The first step to avoiding them is to be aware of them.

Establishing Attainable Financial Objectives prior to Fall.

With summer moving on, it is important to have clear financial targets before the fall season comes round. This includes:

- Revising your existing budget.

- Having targeted savings.

- Changing your expenditure patterns.

This way, you will be in a better position to meet the financial needs of the next season.

Financial planning is not simply a matter of saving; it is a matter of making intelligent decisions that will enable you to live in the present and secure your financial future.

Loud Budgeting: The Trend Changing Not the Way We Speak about Money.

Saying out loud about your budgeting choices is becoming the norm in loud budgeting. This philosophy of personal finance is all about being transparent and aggressive about your choices in budgeting, abandoning the old-fashioned shrouded or covert character of financial planning.

The Question of What Is Loud Budgeting and Why It Works.

Loud budgeting is defined as the act of talking about your financial choices and budgeting techniques publicly. It has to do with being open about your finances, be it turning down costly social events or opting to use more affordable options. This is effective since it creates clear limits and encourages a sense of responsibility.

You can become more accountable to your budget and make mindful financial decisions by being outspoken about your financial ambitions and constraints. Being able to spend consciously on the decisions you make and not merely use money to meet your specific financial goals is not only about saving money.

Loud Budgeting

How to Establish Boundaries Financially.

Achieving success when using loud budgeting is important to set down financial boundaries. Begin with determining your financial targets and boundaries. Define what you are willing to spend and what you are not. Make these limits very clear to others, either by a simple I am on a budget or a more elaborate description.

With such expressions, you are not just saving on money but also fostering an atmosphere of financial transparency and accountability.

How to master the 50:30:20 Rule to Financial Success.

A rule of 50:30:20 when dividing your income may be the best solution to complete your summer on a financially healthy note. With this simple budgeting rule, you can still manage your finances and save and still have a good time during your summer.

Breaking Even the Percentages.

According to the 50:30:20 rule, you should split your income into three parts: needs, wants and savings/debt repayment.

50% toward Needs: Housing, Utilities, Groceries

The other half of your money should be used on things that you need such as housing, utilities and groceries. These are necessities that you cannot ignore.

30% Wants: Entertainment, Dining, Summer Activities.

One-third goes to discretionary spending, such as dining out, entertainment and summer activities. This way you can live a good life and not lose sight of your money.

Savings and Debt Repayment 20%.

Last but not least, 20 percent is allocated to savings and debt repayment. This plays an essential role in developing financial safety and long-term objectives.

| Category | Percentage | Examples |

| Needs | 50% | Housing, Utilities, Groceries |

| Wants | 30% | Dining Out, Entertainment, Summer Activities |

| Savings & Debt Repayment | 20% | Emergency Fund, Retirement Savings, Credit Card Debt |

Tilting the Rule over Seasonal Expenses.

You may spend more money during summertime on holidays or utility costs on air conditioning. To adapt to such seasonal expenses, you can either cut down on discretionary spending temporarily or save up.

50:30:20 Rule for Financial Planning

Conclusion: Integrating Strategies to become financially stronger in the future.

Many consider this a good time of the year to get your Personal Finance strategies in place to help you achieve long-term success. Using Loud Budgeting with the 50:30:20 rule you will have a more stable financial future.

Loud Budgeting teaches you to speak the truth about your financial constraints so you can keep unnecessary costs off your balance sheet. In the meantime, the 50:30:20 rule offers you an easy way to divide your income into the three categories of expenditure: the necessity, the want, and savings.

These Budgeting Strategies can help you move far ahead in your Financial Planning by incorporating them in your daily life. This active strategy will help you leave the summer on a better financial footing and will look to an even safer future.

Get your money under control today and begin living a more secure tomorrow. These strategies will also help you to hit your long-term financial targets.

FAQs

What is the 50:30:20 rule and how does this work?

The 50:30:20 financial plan is an easy budgeting method, by which all your income is divided to 50% of that income goes to essentials such as housing and utilities, 30% goes to discretionary expenses such as entertainment and 20% to savings and debt repayment.

What do I need to do to use loud budgeting in my everyday life?

Loud budgeting is being open and aggressive regarding your financial choices. One way to begin is to establish financial boundaries, communicate your financial priorities with specific phrases, and monitor your spending patterns.

What are a few typical traps in spending in the summer?

Ordinary examples of summer spending pits are holidaying, outside recreation, and eating out. To prevent such traps, you should make financial targets that are realistic, budget on what matters, and find a solution to save on summer activities.

What do I do to modify the 50:30:20 rule on the seasonal costs?

In order to adapt the 50: 30: 20 rule to seasonal costs, you can allocate more of your income towards savings in peak spending periods, such as summer, to reflect greater expenditure.