Which system will actually save your team time and cut errors when tax season comes? This guide looks at leading options used across UK small business teams and compares capability, value and day-to-day usability.

Independent testing rates QuickBooks Online, Xero and FreshBooks highly, each excelling for different business models. The roundup judges invoicing, projects, inventory, time tracking, payroll and management reporting alongside mobile apps and integrations.

The analysis uses weighted criteria: features (50%), expert analysis (30%), price (10%) and customer reviews (10%). It also checks HMRC compatibility, VAT submissions and Making Tax Digital readiness.

Readers will see price snapshots, typical plans and hidden costs that affect total cost of ownership. Alternatives such as Zoho Books, FreeAgent and Sage are noted for businesses with different needs. Practical next steps include trial suggestions and simple implementation tips to move from research to selection with confidence.

Key Takeaways

- QuickBooks, Xero and FreshBooks suit different team sizes and use cases.

- Must-have features include invoicing, time tracking and robust reporting.

- UK rules like Making Tax Digital and VAT submissions shape software choice.

- Compare entry plans, add-ons and bank feeds to gauge real price.

- Free trials and implementation planning reduce migration risks.

Why cloud accounting matters for UK small businesses today

Modern cloud systems bring bank feeds, mobile apps and automatic updates to small business finances. They centralise accounts so teams and advisors can access ledgers securely from any location, supporting hybrid working and faster decision-making.

Automated bank feeds, rules-based categorisation and receipt capture cut manual entry and reduce errors. This improves cash visibility and speeds up tax submissions, as many providers support Making Tax Digital and HMRC filing tools.

Collaboration works in real time. Accountants and owners use the same ledger, which removes file swapping and shortens month-end. Dashboards, alerts and cash flow views help directors act on spending, credit control and purchasing without delay.

- Mobile apps let freelancers and directors raise invoices and approve bills on the go.

- Integrations connect payments, payroll and CRM to build a scalable system.

- Subscription plans give predictable budgeting compared with traditional licences.

| Key area | Benefit | Impact for owners |

|---|---|---|

| Accessibility | Secure cloud access | Faster approvals and remote bookkeeping |

| Compliance | MTD-ready VAT tools | Simpler tax filing and audits |

| Automation | Bank feeds & receipts | Less data entry, better tracking |

How this product roundup was evaluated

The evaluation applied a weighted methodology to rank options by real-world business needs. Scores combine objective testing and market feedback so owners see practical differences between systems.

Scoring model: features carried 50% of the total score, expert analysis 30%, pricing 10% and verified customer reviews 10%. This balance favours core capability while still reflecting cost and support.

Weighted criteria and what we measured

“Features” covered double-entry bookkeeping, invoicing, time tracking, payroll, reporting, inventory controls and automation such as bank rules and receipt capture.

Usability and onboarding were tested by interface clarity, learning resources and training availability. Trial periods and promotional plans were noted where they affect true cost.

| Criterion | Focus areas | Why it matters |

|---|---|---|

| Features (50%) | Invoicing, payroll, time tracking, inventory, automation | Drives day-to-day efficiency and reporting accuracy |

| Expert analysis (30%) | Compliance, integrations, security, scalability | Shows long-term suitability for business growth |

| Pricing & plans (10%) | Entry tiers, included users, add-ons, promo pricing | Determines real monthly cost and value |

| Customer reviews (10%) | Support, reliability, real-world ease of use | Reflects typical user experience |

How SMEs should shortlist options

SMEs should prioritise HMRC-readiness, MTD compatibility and VAT workflows to make sure compliance is built in.

Map essential needs first — projects, inventory, multi-user controls — before being swayed by extras. Check role-based permissions and audit trails if multiple users or external accountants will access ledgers.

“Test mobile apps during free trials to judge receipt capture, invoice creation and approvals in real scenarios.”

- Shortlist systems with strong integrations for payments, bank feeds, payroll and CRM.

- Compare entry plans for included users and modules to avoid surprise cost increases.

Intuit QuickBooks Online: best overall for growing businesses

QuickBooks Online stands out when businesses require scalable reporting, stock control and time tracking.

Key features include invoicing, inventory control, time tracking, payroll and project management. Custom contact and transaction fields let owners tailor reports for audits and management.

Pricing and plans per month (UK)

Entry tiers start from around £14 per month, with promotions sometimes reducing the initial months. Higher plans unlock projects, advanced inventory and payroll, so total price rises as features and users are added.

Strengths and trade-offs for owners

Strengths: rich reporting, inventory tools for product firms, tight project tracking and many integrations with PayPal, Stripe and add-on marketplaces.

Trade-offs: higher cost versus simpler systems and a learning curve for advanced functions. Mobile apps handle invoices and receipts well, but some desktop-only features are limited.

“Make sure you check user permissions, accountant access and project features if teams will bill time or manage stock.”

| Area | What QuickBooks offers | Impact for owners |

|---|---|---|

| Reporting | Custom reports, profitability, cash flow, aged receivables | Better management insight and audit trails |

| Inventory | Stock levels, cost tracking, product records | Accurate COGS and stock control for product sales |

| Projects & time | Time tracking, expenses, progress billing | Unified billing and job profitability tracking |

| Price | From ~£14 per month; add-ons increase spend | Good value if advanced features are needed |

Xero: best for multiple users and deep integrations

For businesses with multiple staff and external advisers, Xero offers wide user access and strong integrations. It scores 4.0 and is known for thorough accounting tools and advanced analytics.

https://www.youtube.com/watch?v=CWbHLoNvohw

Core capabilities: accounts, reporting, projects, analytics

Core modules cover sales and purchases, bills, bank reconciliation and projects. Reporting surfaces trends, profitability and cash flow to help directors act quickly.

Multi-user access, advisor network and HMRC-ready tools

Xero provides unlimited users across most plans and role-based permissions for secure collaboration. It is MTD-compatible and streamlines VAT submissions for UK tax needs.

- Over 1,000 integrations for payments, ecommerce, forecasting and CRM.

- New inventory add-on and payroll links (Gusto in the US); reliable mobile apps and bank feeds.

- Extensive online help and a broad advisor network to support onboarding.

“Test the interface and project flow — time entries must link to projects and templates can be fiddly.”

Price context: UK plans commonly start around £15 per month and include unlimited users. Teams should test the interface and data flows to check fit before committing.

FreshBooks: best for service-based businesses and time tracking

FreshBooks is a service-first platform rated 4.5 for its user experience and time tools. It suits freelancers, consultants and creative agencies that need clear invoices, retainers and simple project billing. UK plans typically start at about £15 per month and include mobile apps, time capture and basic expense tracking.

Standout tools: invoicing, retainers, projects and mobile apps

Invoicing is polished and client-facing, with recurring templates and payment links to speed collections. Projects support retainers, billable hours and progress billing so budgets stay accurate.

The time and tracking features let teams log hours on desktop or mobile. Expenses and mileage can be added quickly, improving billing accuracy and reducing disputes.

Limitations to consider for inventory-heavy companies

Inventory tracking is basic, so product-led businesses should prefer QuickBooks or Xero. Adding extra users and advanced tools increases monthly spend, so owners should model real costs before committing.

“Make sure proposals, retainers and reporting align to your client delivery model before committing.”

| Area | Why it matters | Impact for owners |

|---|---|---|

| Time tracking | Accurate billable hours | Better client billing and profitability |

| Invoicing | Polished client documents | Faster payments and fewer disputes |

| Price | From ~£15 per month | Good for solo operators; team costs add up |

A Comprehensive Review of the Top 3 Cloud Accounting Software for SMEs

QuickBooks Online, Xero and FreshBooks earn top marks because each maps to a clear company profile and operational priority.

QuickBooks fits product-led firms needing deeper inventory and project tracking. Xero suits teams that want many users and broad integrations. FreshBooks favours service businesses that rely on time tracking and polished invoices.

All three provide reliable double-entry accounting, solid reporting and everyday management tools. They share good bank feeds, receipt capture and automation, though each executes these features slightly differently.

Choose by fit, not by score. Pricing tiers and add-ons change monthly cost significantly, so scope needs carefully before buying. Usability and onboarding differ, so trials help reveal real learning curves and interface preferences.

“Fit-to-use case outweighs a generic best label when measuring adoption and return on investment.”

- Advisor ecosystems and community support vary; this affects implementation and growth.

- Check role permissions and audit trails if multiple staff or external accountants will access records.

- Review reporting libraries to confirm management and statutory needs without heavy customisation.

| Area | QuickBooks | Xero | FreshBooks |

|---|---|---|---|

| Best for | Inventory and project depth | Multi-user collaboration | Service time tracking |

| Core strength | Advanced stock & reporting | Integrations & advisors | Invoices & retainers |

| Pricing influence | Add-ons for inventory/payroll | Unlimited users; integration costs | Extra users raise monthly spend |

| Implementation note | May need training for advanced features | Strong advisor network for onboarding | Very quick to start for freelancers |

For further context on cloud platform choices and SaaS implications, consult this cloud technology primer.

Head-to-head features comparison: reports, inventory, projects, invoices

This side-by-side look focuses on how each platform handles reports, stock, job costs and invoicing workflows.

Reporting and reports: QuickBooks leads with numerous custom reports and deep custom fields. Xero offers advanced analytics and dashboards via add-ons. FreshBooks delivers streamlined project and time reports aimed at service teams.

Advanced automations that save time

Automation, bank feeds and receipts are standard. All three support bank rules, scheduled invoices and receipt capture to speed reconciliation and reduce manual entry.

Customisation, dashboards and management reporting

QuickBooks gives broad custom fields and form templates for management insight. Xero uses integrations to expand dashboards and data visualisation. FreshBooks keeps the interface simple so teams see project profitability and unpaid invoices quickly.

- Inventory: QuickBooks offers robust stock tracking; Xero has an add-on route; FreshBooks is basic for products.

- Project & time tracking: FreshBooks and QuickBooks excel at job costing and billable hours; Xero provides solid project tools for teams.

- User control: All include permissions and audit trails; teams should test accountant access and approval workflows.

“Choose by the workflows you use every day, not by the rare advanced feature.”

| Area | QuickBooks | Xero | FreshBooks |

|---|---|---|---|

| Reports | Highly customisable | Analytics via add-ons | Project-focused reports |

| Inventory | Robust stock control | Add-on inventory | Basic |

| Invoices | Custom templates & reminders | Flexible templates | Polished client-facing invoices |

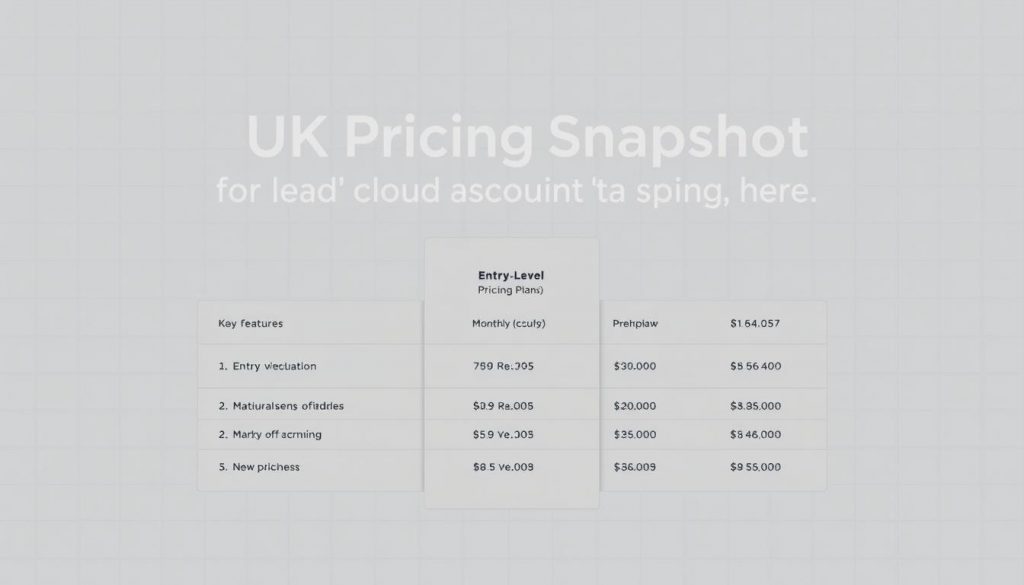

UK pricing snapshot: entry plans, add-ons and true cost per month

Entry-tier pricing varies widely across UK providers, and early discounts can mask long‑term spend. Typical starting figures are QuickBooks ~£14 per month, Xero ~£15 per month and FreshBooks ~£15 per month. Other options range from Zoho Books at ~£12 to Tide at £9.99, while FreeAgent may be free with eligible NatWest/RBS/Ulster Bank accounts.

What’s included in base plans vs paid add‑ons

Base plans usually cover core invoicing, bank feeds and basic reports. These features suit many small business users who need everyday accounting and reconciliations.

- Included: invoicing, bank connections, basic reporting and mobile receipt capture.

- Often extra: payroll modules, advanced analytics, project modules and document scanning.

- User rules: some vendors allow unlimited users; others charge per additional seat.

Hidden costs to watch: payroll, extra users, advanced reporting

Promotions (50–90% off initial months) can reduce the first bill but owners should model a 12‑month average. Budget for payroll, extra users, premium support and payment processing fees linked to built‑in links.

| Provider | Typical start (per month) | Common add‑ons |

|---|---|---|

| QuickBooks | ~£14 | Payroll, inventory, extra users |

| Xero | ~£15 | Payroll, analytics add‑ons, integrations |

| FreshBooks | ~£15 | Extra users, advanced projects |

Owners should confirm VAT, MTD filing and contract terms before committing. Comparing plans and averaging promotional months gives a realistic per month cost and avoids surprises.

Making Tax Digital, VAT and HMRC compliance essentials

Making Tax Digital sets clear rules for how VAT records must be kept and submitted digitally. Companies must hold digital records and use compatible tools to send returns to HMRC each period.

QuickBooks and Xero promote HMRC-ready workflows that cut manual entry and reduce tax errors. FreshBooks supports tax processes commonly needed by service firms.

Configure VAT codes correctly from day one and keep mappings clean. Use audit trails, locked periods and role-based permissions to tighten controls and help with management reviews.

- Capture accurate data via bank feeds and receipt imaging to back up returns.

- Run standard reports and exports so HMRC queries or an external accountant can be answered quickly.

- Set calendar reminders for submission deadlines and enable in-app alerts where possible.

Reconcile frequently and clear suspense accounts to avoid misstatements. Share secure access with an accountant for timely checks and adjustments.

Choosing MTD-compatible platforms reduces risk and lowers administrative burden at quarter end.

Ease of use and onboarding for teams and freelancers

An intuitive interface and guided setup make a big difference for small teams and freelancers learning new accounting tools.

FreshBooks is praised for context‑sensitive prompts that help non‑accountants create invoices and track time quickly. Xero provides extensive online help and a strong adviser network for questions during onboarding. QuickBooks offers deep customisation but may need more time for advanced features.

Practical rollout cuts friction: connect bank feeds first, then enable invoicing and bills. Use sandboxes or sample data so users practise bookkeeping without risk.

- Check the interface in a free trial to judge navigation and report builders.

- Create simple SOPs for invoices, expenses and month‑end to standardise use.

- Set role‑based access and onboarding checklists for new users and external advisers.

- Measure success with time to reconcile and days sales outstanding so owners see real gains.

“Phase features and train with real examples; mobile receipt capture speeds adoption across the team.”

Mobile apps and remote bookkeeping: managing finances on the go

Teams increasingly rely on phone apps to capture expenses and approve invoices during site visits. Modern iOS and Android clients let users snap receipts, create invoices and start timers without returning to an office.

iOS and Android capabilities for receipts and invoices

QuickBooks, Xero and FreshBooks all include apps, but they differ in depth. QuickBooks’ app sometimes hides advanced features found on desktop. Xero and FreshBooks get high marks for clear project and time controls.

Practical benefits:

- Offline capture with later sync keeps records when signal is poor.

- Bank feed review in-app speeds reconciliation and eases month‑end work.

- Push alerts for overdue invoices and approvals reduce delays.

Security and process tips: enable biometric login and two‑factor authentication, train staff to photograph receipts promptly, and test multi-line invoices, expense re-billing and project timers on each platform.

“Good mobile capability supports remote bookkeeping and faster collaboration with external accountants.”

Integrations and ecosystem: payments, CRM, bank feeds and links

Linking bank feeds, payment links and project tools reduces manual entry and speeds reconciliation.

Seamless bank connections are essential for daily reconciliations and an accurate cash picture. Good bank feeds reduce manual matching and cut errors.

Payment processors such as PayPal and Stripe appear across platforms. They let invoices include payment links so customers can settle faster.

Popular connections: PayPal, Stripe, banking and project tools

Xero offers a marketplace with 1,000+ apps and an extensive adviser network for sector‑specific needs.

QuickBooks supports many add-ons for advanced reporting, inventory and field service. FreshBooks focuses on simple links that suit service firms and project/time workflows.

- CRM & ecommerce: sync customers, orders and invoices to avoid duplicate entry.

- Project & time: trackers feed hours into billing for unified job invoicing.

- Bank feeds: keep transactions in sync for timely reconciliations.

Practical advice: review which vendor owns an integration and check support SLAs. Ask for data flow diagrams so critical records stay in sync.

“Test two or three key integrations during trials to validate stability and reconciliation outcomes.”

| Area | Why it matters | Typical benefit |

|---|---|---|

| Bank feeds | Daily transaction import | Faster reconciliations, accurate cash view |

| Payments (PayPal/Stripe) | Instant invoice settlement | Lower days sales outstanding |

| CRM / Ecommerce | Customer & order sync | Less duplicate data, cleaner reporting |

| Project / Time tools | Billable hours to invoices | Clear job profitability |

Plan an integration roadmap that prioritises stable, well‑supported apps. This approach avoids a fragile stack and helps businesses scale with fewer interruptions.

Security and data protection: backups, GDPR and user permissions

Owners should expect end-to-end protection, routine backups and strict access rules from any modern solution. Leading accounting software uses SSL for encryption in transit and encrypts stored data at rest to safeguard personal and financial records.

Providers also run automated backups across multiple secure servers. This reduces risk from hardware failure and short outages and supports quick restores when required.

GDPR compliance matters: platforms must support data minimisation, clear retention policies and role-based access controls so a company can meet regulatory obligations.

- Enable two‑factor authentication for all users, especially administrators and external accountants.

- Apply least‑privilege access and review permissions regularly to limit insider risk.

- Use audit trails and period locking to preserve integrity for external reviews and audits.

- Enforce device hygiene for mobiles and laptops that access the system.

- Check vendor certifications, data residency and document incident response contacts.

Practical advice: align security controls to the company risk profile and chosen accounting needs, and record escalation paths with the vendor to reduce downtime after an incident.

Scalability: from sole traders to SMEs with multiple users

Growing firms must plan how their accounting tools will handle more users, transactions and reporting needs.

Start with essentials: invoicing, bank feeds and simple reconciliations suit sole traders and micro teams. As the business grows, approvals, role‑based permissions and departmental reporting become critical.

Xero offers unlimited users across tiers, which helps collaboration with advisers and expanding teams. This removes seat‑cost barriers and speeds advisor access for timely checks.

QuickBooks scales by edition and add‑ons. Companies can unlock payroll, inventory and advanced reporting without migrating platforms. That flexibility suits firms that expect modular growth.

FreshBooks grows well for service teams thanks to improved project and billing tools. It is less suited to inventory‑heavy companies, so product firms should check feature depth before committing.

- Review transaction limits and API quotas for high‑volume processing.

- Plan multi‑entity consolidation and fixed‑asset tracking if expansion is likely.

- Align automation and segregation of duties with organisational structure.

Choose systems that allow exports and clean migrations to avoid vendor lock‑in. As stakeholders increase, scalable dashboards and strong advisor networks matter more for management oversight and process optimisation.

“Prioritise platforms that match current needs and offer clear upgrade paths as complexity rises.”

| Area | Why it matters | Practical check |

|---|---|---|

| Users & access | Collaboration with teams and advisers | Check user limits and permission granularity |

| Transactions & API | Performance at scale | Confirm quotas and sync reliability |

| Reporting | Stakeholder visibility | Test consolidated reports and dashboards |

Best alternatives if the top three don’t fit your needs

If a company requires deeper inventory, tighter bank links or a lower price point, look beyond the main vendors.

Zoho Books — automation and ecosystem depth

Zoho Books suits growing small business teams that want automation and broad app links. It scores 4.0 and offers a free tier and paid plans from about £12 per month.

Its modules rival many larger suites and give strong customisation for invoices, workflows and CRM sync. This is a good option when integrated tools and automation matter.

Sage 50 — inventory and established companies

Sage 50 Accounting is aimed at established companies that need robust inventory and deep reporting. It also scores 4.0 for feature depth.

Owners should note it is primarily desktop software with no mobile apps, so weigh that trade-off against its advanced stock and compliance capabilities.

FreeAgent — freelancers with UK bank offers

FreeAgent is tailored to freelancers and contractors in the UK. It integrates well with HMRC workflows and can be free for NatWest, RBS and Ulster Bank customers.

This solution keeps tax and invoicing simple for sole traders while offering the right UK-focused reporting for accountants.

Wave and Crunch — budget-friendly invoicing and basics

Wave provides straightforward invoicing at low cost, though it lacks project time tracking. Crunch offers a free basic plan for sole traders and micro-businesses that need simplicity.

Both are useful where price and simple invoicing trump advanced features like project billing or inventory control.

- Match features to needs: choose by multicurrency, inventory depth or CRM links, not brand alone.

- Check support and learning curve: complex suites like Zoho or Sage may need more onboarding.

- Assess total cost: include add-ons, accountant collaboration and bank feed reliability when comparing plans.

- Verify compliance: confirm MTD/VAT readiness and HMRC-compatible workflows before committing.

“Trial each alternative with real invoices and bank flows to make sure critical gaps do not appear after adoption.”

Which software suits you? Matching plans to business use cases

The best match balances daily processes—time capture, stock control and multi-user approvals—against monthly cost. Owners should start by listing core needs and the workflows they use every day.

Service-based, product-based and hybrid businesses

Service-led firms benefit from platforms that simplify time capture, retainers and client invoices. FreshBooks excels here with intuitive timers and polished client documents.

Product businesses need strong inventory, purchase workflow and profitability reports. QuickBooks is the usual fit for those requirements.

Hybrid teams that mix services and goods should favour systems with unlimited users and broad integrations. Xero works well for collaborative teams that link multiple apps and advisers.

Project tracking, inventory and multi-user requirements

Verify project accounting features: task-level budgets, expense capture and time tracking that feed invoices and job P&Ls.

Test inventory depth: stock valuation, purchase orders and cost of goods sold reporting matter for retail and manufacturing.

Where many users access records, check role permissions, approval workflows and audit trails to keep controls tight.

- Check reports: confirm templates and custom fields meet management and statutory reporting needs.

- Test mobile: field teams should capture receipts and raise invoices on site.

- Balance plans: pick must-have features first and avoid costly extras that add little value.

- Define success: use DSO, time to close month and invoice turnaround as trial metrics.

“Match real daily tasks to plan capabilities rather than buying for hypothetical future needs.”

Next steps: how to trial, compare and implement your chosen system

Begin trials with real workflows to see how each platform handles bank reconciliation, invoicing and VAT checks. Most providers offer 30‑day trials and short‑term discounts before standard monthly pricing returns, so test beyond any promotion period.

Practical checklist:

- Run two or three free trials and replicate core tasks: bank feeds, invoice creation and VAT submission.

- Score must‑have features on a simple checklist and note hidden add‑ons such as payroll or advanced reporting.

- Schedule demos with vendor specialists to answer specific questions about permissions, integrations and reports.

- Test mobile apps alongside desktop to confirm parity for receipts, invoices and approvals.

Implementation basics: connect bank feeds first, import opening balances and contacts, and configure VAT codes. Pilot a single department or month before full cutover to reduce risk.

Set SOPs, train users, enable two‑factor authentication and plan the first month‑end close with an external accountant. Agree measurable goals for reconciliation time, invoice cycle and bookkeeping impact, then review plan tiers after 60–90 days to right‑size costs and features for management and owners.

“Use trials to answer practical questions, not just to compare price tags.”

Conclusion: A Comprehensive Review of the Top 3 Cloud Accounting Software for SMEs

The right accounting platform should speed routine tasks and make management data clearer.

QuickBooks suits growing firms that need deep features and extensibility. Xero fits collaborative teams that value unlimited users and rich integrations. FreshBooks favours service-led businesses that need elegant time capture and client billing.

Small businesses should run trials, test mobile apps and confirm MTD/VAT readiness before committing. Watch add-ons and user fees to manage the true monthly cost, and engage an accountant early to validate setup.

Good automation for invoices, receipts and bank feeds saves time and cuts errors, making finances more visible and management reporting more reliable. Choose the system that meets today’s goals and scales sensibly for tomorrow.

FAQ

Which package is best for a growing UK small business that needs payroll and projects?

QuickBooks Online’s mid to advanced plans suit growing companies that need payroll, project tracking and comprehensive invoicing. It bundles payroll as an add-on or within higher tiers, offers job costing and integrates with HMRC for PAYE submissions.

Can Xero handle multiple users and accountant access without extra complexity?

Yes. Xero is built for multi-user access and provides an advisor network that simplifies collaboration. User permissions are granular, so accountants and team members can be given appropriate access without exposing all company data.

Is FreshBooks a good choice for freelancers and service-based firms?

FreshBooks excels for service providers and freelancers thanks to strong time tracking, retainers and client-facing invoices. It is less suited to complex inventory management, so product-heavy businesses may prefer Xero or Sage.

How much should a small business expect to pay per month in the UK?

Entry plans typically start from single-digit to low double-digit pounds per month. Essential features often require mid-tier plans or paid add-ons; include potential costs for payroll, extra users, advanced reporting and payment processing when budgeting.

Are these systems compliant with Making Tax Digital and HMRC requirements?

Yes. QuickBooks, Xero and FreshBooks offer HMRC-ready tools and MTD-compatible VAT returns. Businesses must ensure settings and submission processes are correctly configured and keep digital records to meet MTD rules.

What integrations should businesses look for when choosing accounting software?

Look for bank feeds, payment providers like Stripe and PayPal, invoicing and CRM connections, plus project management tools. Robust integrations reduce manual data entry and streamline reconciliations.

How easy is onboarding for teams and freelancers?

Onboarding varies by vendor. Xero and QuickBooks include guided setup, migration tools and accountant support. FreshBooks focuses on simpler workflows for solo operators. Consider available training, support channels and data migration services.

Are mobile apps reliable for invoicing and receipt capture?

Yes. All three vendors provide iOS and Android apps that support invoices, expenses and receipt photo capture. They allow real-time updates, though advanced reporting and bulk tasks work best on desktop.

What security and data protection measures do these platforms offer?

They use encryption, regular backups, GDPR-compliant policies and role-based permissions. Businesses should enable two-factor authentication and review data retention policies to meet internal and regulatory requirements.

Which option is best for inventory-heavy retailers?

Xero plus specialised inventory apps or Sage are preferable for complex stock control. QuickBooks offers basic inventory management, while FreshBooks lacks advanced inventory features and is not ideal for product-heavy firms.

How can a company avoid hidden costs when choosing a plan?

Review what each base plan includes versus paid add-ons such as payroll, extra users, premium support and advanced reports. Ask vendors about transaction fees, bank feed limits and third-party app costs before committing.

Are there good lower-cost alternatives if these three don’t fit a budget?

Yes. Zoho Books, FreeAgent and Sage offer competitive features for different needs; Wave and Crunch are affordable for basic invoicing and bookkeeping. Match functionality to business needs to avoid overpaying.

How should a business trial and compare these systems?

Use free trials to test day-to-day tasks: invoicing, reconciliations, payroll and reporting. Import sample data, test integrations and involve the accountant or bookkeeper to assess workflows and support quality.