With the beginning of 2025, it is important that we know the major economic indicators to make a sensible financial choice. The evolutions in the sphere of the economy suggest focusing on some metrics, which could really influence our financial welfare.

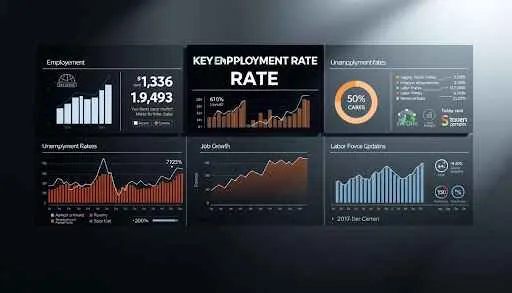

Economic Indicators:

Among the most important indicators to monitor are the level of inflation and the rate of employment. The rate of inflation influences the ability of consumers to buy goods, and the rate of employment will determine the stability of the economy. These indicators are important as they can be used in guiding people and enterprises through the twists and turns of the economy.

With these major indicators that we are observing closely, we are also in a better position to predict such economic changes and know how to act properly.

Key Takeaways:

- Keep track of the rate of inflation so as to know how purchasing power has changed.

- Monitor the rate of employment to determine the stability of an economy.

- Revise financial judgement in view of the variations in economic pointers.

- Be periodically aware of world economic trends.

- Economic indicators can be used to foresee and plan economic changes.

The Economic Outlook till 2025:

It seems that the year 2025 will be instrumental in the future of the global economy, and there are many factors involved. These changes have become important to comprehend by businesspeople, policymakers, and ordinary individuals.

Capitalistic Economics after the Pandemic:

The world economy is in its stage of recovery after suffering all the effects of the pandemic, and all the economies have different levels of recovery. GDP growth pattern is one of such indicators to monitor since it captures the economic performance as a whole.

One of the main sources of economic recovery in most countries, including the U.S., has been consumer spending. Nonetheless, inflation rates and the level of employment, among others, determine the rate of spending.

The U.S. Economy Impacts of Global Factors:

The economy of the U.S. is highly affected by global events and economic politics.

- Other countries policies on trade and tariffs may impact exportation and importation of the U.S.

- Prices of commodities in the global market, especially oil may affect inflation and personal expenditure.

- International capital flows and investment decisions may be influenced by monetary policies e.g. interest rates put in place by key central banks.

Key Economic Indicators to monitor inflation:

We are moving into 2025 and monitoring the level of inflation will be vital to an stable economy. Inflation influences the buying capacities of consumers and profits of companies. In order to grasp the concept of inflation, several vital economic indicators have to be observed.

CPI Forecasts:

Consumer Price Index (CPI) is one of the key indicators of inflation. It is a measure of movement in prices of a basket of goods and services consumed by households. It is important to consider the CPI estimates in 2025 so as to understand which inflation trends can be expected.

CPI non-negligible determinants are:

- Prices of food and energy

- Housing costs

- Clothing and transport expenses

Analysts believe that global events and economic policies of the country will still affect CPI.

Trend in Producer Price:

Producer Price Index or PPI is a measure of average price change that producers, at a domestic level, earn on their output. The trend of PPI can be used to predict inflation in the future as manufacturers transfer higher prices to the customers.

Development trends in the PPI have been as follows:

- Rising expenses in production

- Dynamics of the prices of the raw materials

Interest Rate Policies of the Federal Reserve:

The interest rate policies of the Federal Reserve have a great influence on inflation. By regulating the interest rates, the Fed is capable of affecting the cost of borrowing, consumer spending, and consequently inflation.

The strategies of the Fed are:

- Modifying the federal funds rate

- Quantitative easing or tightening, Data leakage, surveillance, sniping or ratting in online games Time shifting in film viewingTextBox in context of feminist criticism

These policies are important in anticipating future inflation in the year 2025.

Indicators of Economic Activity in Key Employment and Labor Market:

There are a number of labor market indicators, which will affect the state of employment in 2025. These are important indicators that should be understood in the evaluation of the overall health of the economy. The trends on employment and labour market give an insight on how the economy may move in the future.

Forecasts of Unemployment Rate:

Unemployment rate is one of the major determinants of health of the labor market. It is expected that by 2025 the unemployment rate can stabilize and minorly decline as the economy keeps recovering the effects of the pandemic. The economists forecast a range between 3.5 4.5 percent, which is the sign of the robust market.

LFP Trends:

Another important measurement is the level of labor participation. The industry trends show that there is slow but steady growth in participation rates as more people re-enter the labour market. Among the factors that have affected the trend are the modification of the retirement ages and the enhanced involvement of some groups of the population.

Anticipations of wage development:

The growth of wages will carry on rising further into the year 2025 due to healthy labor and the growth in demand for skilled professionals. The increase in wages is expected to be between 3 and 4 percent, which will be useful to the workers, although it may also affect inflation rates.

Cross-Sectoral Job Creating:

The creation of employment opportunities is a very healthy indicator of the economy. Different industries will be facing job creation in the future, with technology and healthcare firms being predominant. The employment situation will also trend toward remote work and the gig economy, and influence the job creation pattern.

The conclusion: Going through a Time of Economic Transitions in 2025.

Into the future, prolonging into 2025 years, various economic indicators are very essential to come up with sound financial analysis. The index of consumer prices, the index of producer prices, and the interests rates policy of the Federal Reserve will play important roles in monitoring the trends in inflation.

In the meantime, statistics of the labor market, the unemployment rate, the level of participation in the labor market, and wage gains will shed more light on the labor market situation.

In order to avoid being caught off guard by the mechanisms that are set into place by these economic changes, it is important to keep track of such indicators and adapt financial strategies to these changes. Through keen observation of the Economic Indicators, people as well as businesses will be able to predict and react to changes in the economy more easily and finally make sounder judgments.

Since one can always stay ahead of the curve and know how to deal with the changes in the economy, they can maximize their financial planning and reach their goals in a dynamic economic situation as a reader.

FAQ:

Which economic indicators are the most important in 2025?

The major economic indicators one should be monitoring in 2025 are inflation, employment rate, the Consumer Price Index (CPI) estimates, Producer Price Index (PPI) trends, the interest rate policy of the Federal Reserve, unemployment rates projections, labor force participation rates projections, the increase of wages, as well as growth of jobs in various sectors.

What economic effects are caused by inflation?

The factors that inflation can affect the economy are the decrease in purchasing power in consumers, the rise in the cost of living, and interest rates. Realizing the tendencies of inflation is important to make appropriate financial plans.

What is the Consumer Price Index(CPI), and why has it become such an important tool?

Consumer Price Index (CPI) represents the average level of prices of a so-called basket of goods and services purchased by households. It is a necessary component used in monitoring inflation and in discovering how the economy in general is doing.

What are the implications of the Federal Reserve interest rate policy to the economy?

The federal reserve interest rate policies can have serious effects to the economy given that they affect the cost of borrowing and spending as well as investment choices. Adjustment of interest rate may also influence the dollar price and the general economic growth.