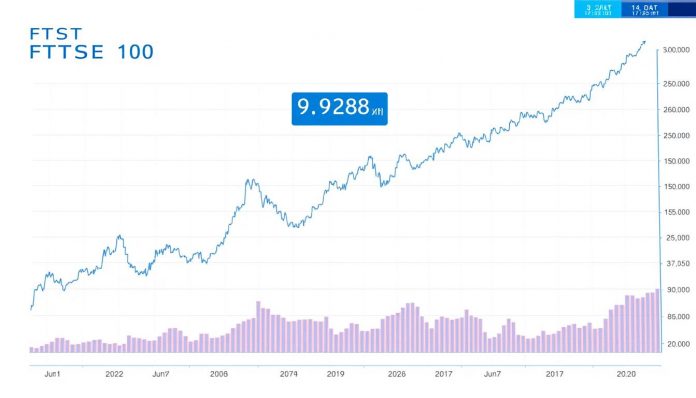

FTSE 100’s Record-Breaking Performance

The FTSE 100 has demonstrated remarkable resilience, climbing to a new record high of 9,288 points with an intraday peak exceeding 9,301. This represents a significant milestone for London’s blue-chip index, which has outperformed many global counterparts during recent trading sessions. The index has gained over 1% in a single day – its best performance in over a month – while other major indices like the Nasdaq and S&P 500 experienced declines.

This surge comes at a time when UK inflation has risen to 3.8%, creating what market analysts describe as a “fascinating divergence” between economic indicators and investor sentiment. The FTSE 100’s strong performance amid these conditions highlights the unique composition and global exposure of Britain’s premier stock index.

Key Drivers Behind the FTSE 100 Surge

Weaker Pound

The pound’s relative weakness has boosted overseas earnings for FTSE 100 companies when converted back to sterling. With approximately 75% of FTSE 100 revenue generated internationally, currency movements significantly impact reported earnings.

Sector Strength

Mining and banking stocks have been powerful performers. Companies like Anglo American (+4.8%), Rio Tinto (+3.9%), and Glencore (+3.7%) have led the charge, benefiting from elevated commodity prices and robust earnings reports.

Rate Cut Expectations

The Bank of England’s hints at potential interest rate cuts have lifted investor confidence. Softer retail sales data and signs of a cooling job market have strengthened expectations of a more dovish monetary policy approach.

These factors have combined to create a perfect environment for FTSE 100 growth. While tech-heavy indices like the Nasdaq have faced selling pressure amid AI valuation concerns, the FTSE 100’s more diverse composition has proven advantageous in the current market climate.

Inflation Trends Conflicting with Market Optimism

The UK’s inflation rate has climbed to 3.8%, its highest level since February 2024. This uptick has been primarily driven by rising airfares, food prices, and fuel costs. According to the Office for National Statistics (ONS), food price inflation continues to climb, with items such as coffee, fresh orange juice, meat, and chocolate seeing the biggest rises.

This inflationary pressure creates a challenging backdrop for the Bank of England’s Monetary Policy Committee (MPC). While the committee cut interest rates at its most recent meeting, the decision was accompanied by what analysts describe as a “hawkish tilt” reflecting concerns about rising price pressures.

“With the Bank of England’s Monetary Policy Committee paying close attention to trends in service sector inflation, confirmation that prices nudged higher again last month, from 4.7% to 5%, will cause concern,” notes Jeremy Batstone-Carr, European strategist at Raymond James.

The contradiction between rising inflation and market optimism highlights the complex interplay between monetary policy, global trade dynamics, and investor sentiment. While inflation typically presents headwinds for equity markets, the FTSE 100’s unique characteristics have allowed it to buck this trend – at least for now.

Technical Breakdown: Top-Performing FTSE 100 Components

| Company | Sector | Daily Change | Key Driver |

| ConvaTec Group | Healthcare | +5.2% | New $300 million buyback program |

| Anglo American | Mining | +4.8% | Commodity price strength |

| Rio Tinto | Mining | +3.9% | Global demand for metals |

| Glencore | Mining | +3.7% | Energy market strength |

| United Utilities | Utilities | +1.8% | Defensive positioning |

| Unilever | Consumer Goods | +1.5% | Dividend appeal |

The FTSE 100’s recent gains have been broadly based but with powerful contributions from mining, utilities, and consumer staples sectors. This sector rotation – from growth-oriented technology stocks to more value-oriented and dividend-paying companies – reflects changing investor priorities in the current economic climate.

As IG chief market analyst Chris Beauchamp noted: “The FTSE 100 has happily surged to a new high while the rest of the world seems consumed by worries about AI and what Powell might say at Jackson Hole. After two weeks of a dash back to growth stocks, the dividend payers of London’s top index have regained their lustre.”

FTSE 100 vs. Global Indices: A Comparative Analysis

While the FTSE 100 has reached new heights, other major global indices have shown mixed performance. The German DAX has also hit record levels, but US indices have faced headwinds, with the Nasdaq down 1.2% and the S&P 500 down 0.5% in recent sessions. This divergence highlights the different composition and economic drivers of these indices.

FTSE 100 Advantages

- High exposure to mining, energy, and financial sectors benefiting from current economic conditions

- Relatively lower technology weighting compared to US indices

- Strong dividend yields attracting income-focused investors

- Currency benefits from weaker pound boosting overseas earnings

US Market Challenges

- Technology sector under pressure amid AI valuation concerns

- Tariff uncertainties creating market volatility

- Federal Reserve policy uncertainty ahead of Jackson Hole symposium

- Higher valuations creating vulnerability to sentiment shifts

The contrasting performance of these indices reflects their different sector compositions and economic exposures. While the tech-heavy US indices have been impacted by concerns about AI valuations, the FTSE 100’s more balanced sector exposure has proven advantageous in the current environment.

Monetary Policy and Geopolitical Factors

The Bank of England’s approach to monetary policy amid rising inflation has been a key factor influencing market sentiment. While the central bank cut interest rates at its most recent meeting, the decision was accompanied by cautionary language about inflation risks. This careful balancing act has been interpreted positively by markets, with investors appreciating the measured approach.

ING economist James Smith suggests that the hotter-than-expected UK inflation was driven primarily by airfares and that the Bank of England “won’t be too concerned.” However, he notes that officials are keeping an “unusually keen eye on food inflation right now,” which has picked up further to 4.9%, from 2% at the end of last year.

“That all leads us to think a November rate cut is still more likely than not, though it’s not a particularly high conviction call right now given the very evident division on the rate-setting committee,” Smith explains.

On the geopolitical front, trade tensions and tariff concerns have created background uncertainty but have not significantly dampened FTSE 100 sentiment. The UK’s position in these trade discussions has been relatively favourable compared to some EU counterparts, potentially providing another tailwind for London-listed stocks.

Expert Forecasts: Is the FTSE 100 Rally Sustainable?

Market analysts are divided on the sustainability of the FTSE 100’s record run amid persistent inflation pressures. While some see the current rally as well-supported by fundamentals, others caution that inflation could eventually create headwinds for corporate profits and consumer spending.

Bull Case

- FTSE 100 companies have strong international exposure, providing inflation hedging

- Resource companies benefit from commodity price inflation

- Banks can benefit from higher interest rate environment

- Relatively low valuations compared to US counterparts

- Dividend yields remain attractive in comparison to bond yields

Bear Case

- Persistent inflation could force more aggressive monetary policy

- Consumer spending may weaken as inflation erodes purchasing power

- Housing market vulnerability as mortgage rates remain elevated

- Global trade tensions could disrupt supply chains

- Technical indicators suggest market may be overbought short-term

Market analyst Kenny Polcari at Slatestone Wealth offers a cautionary perspective, noting that the UK’s inflation situation serves as a “cautionary tale” for the US. “July’s UK inflation ran 3.8%. While the UK is struggling with services and food, they also face labor and policy-driven pressures,” he says, drawing parallels to concerns held by Federal Reserve Chair Jerome Powell.

Despite these concerns, many analysts remain constructive on the FTSE 100’s prospects, particularly given its attractive valuation relative to other developed market indices and its exposure to sectors that can perform well in an inflationary environment.

Investment Implications and Strategies

For investors navigating the current market environment, the FTSE 100’s performance amid inflation pressures offers several strategic considerations. The index’s composition – with its significant weighting toward sectors that have historically provided inflation protection – may offer advantages in the current economic climate.

Key sectors to watch include:

Resources

Mining and energy companies can benefit from rising commodity prices, which often accompany inflation. The FTSE 100’s significant exposure to these sectors provides natural inflation protection.

Financials

Banks can benefit from higher interest rates, which often accompany inflation control measures. The FTSE 100’s banking exposure may provide resilience if rates remain elevated.

Consumer Staples

Companies selling essential goods often have pricing power during inflationary periods. FTSE 100 constituents like Unilever and Reckitt Benckiser may demonstrate resilience.

Investors should consider maintaining exposure to the FTSE 100 as part of a diversified portfolio strategy, particularly given its relatively attractive valuation and dividend yield compared to other developed market indices.

Frequently Asked Questions

Why is the FTSE 100 rising when inflation is high?

The FTSE 100 can rise during periods of high inflation for several reasons. First, many FTSE 100 companies generate significant revenue overseas, which benefits from a weaker pound. Second, the index has substantial exposure to sectors like mining, energy, and banking that can perform well in inflationary environments. Finally, expectations of eventual interest rate cuts as inflation moderates can boost equity valuations.

How does UK inflation compare to other major economies?

At 3.8%, UK inflation remains above the Bank of England’s 2% target but has moderated from its peak. This is broadly comparable to inflation rates in the Eurozone but higher than Japan. The US has seen inflation moderate to around 3%, though core inflation remains sticky. The UK’s inflation challenge is particularly pronounced in services and food prices.

Will the Bank of England continue cutting interest rates despite inflation pressure?

The Bank of England faces a delicate balancing act. While it has begun its rate-cutting cycle, the pace and extent of future cuts will depend on inflation trends. Most economists expect a cautious approach, with potential for another cut in November if inflation pressures show signs of easing. However, persistent inflation in services and food could delay further cuts.

Which FTSE 100 sectors perform best during inflation?

Historically, sectors with pricing power and hard asset exposure tend to perform best during inflationary periods. Within the FTSE 100, this includes mining companies (Anglo American, Rio Tinto, Glencore), energy firms (BP, Shell), banks (HSBC, Lloyds), and consumer staples with strong brands (Unilever, Diageo). Utilities with inflation-linked revenue models can also provide some protection.

Conclusion: Navigating the FTSE 100 Amid Inflation Pressure

The FTSE 100’s record-breaking performance amid rising inflation presents both opportunities and challenges for investors. While the index has demonstrated remarkable resilience, supported by its sector composition, global revenue exposure, and relative valuation advantage, the persistence of inflation pressures cannot be ignored.

For investors, maintaining a balanced approach that acknowledges both the FTSE 100’s strengths and the potential risks from persistent inflation appears prudent. The index’s global exposure and sector diversity provide natural hedges against some inflation effects, but selective positioning within the index may offer additional advantages.

As the market continues to evolve in response to inflation data, monetary policy decisions, and global economic trends, staying informed and maintaining a long-term perspective will be essential for investors seeking to capitalize on the opportunities presented by the FTSE 100’s current strength while managing the risks associated with persistent inflation pressure.