The British engineering giant is aggressively positioning itself to become a dominant force in nuclear energy through its small modular reactor (SMR) technology.

With ambitious targets that include becoming the UK’s largest company by market value, Rolls-Royce is betting that its nuclear expertise will power not just homes and businesses, but also its own remarkable corporate renaissance.

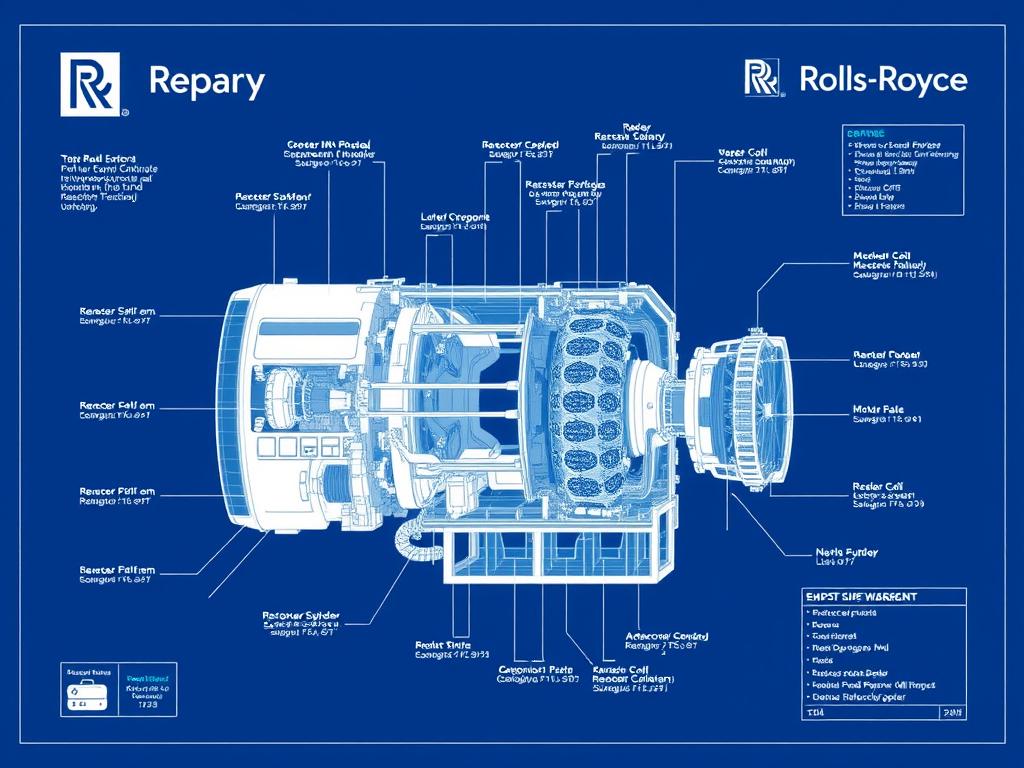

Each Rolls-Royce SMR is designed to generate 470 megawatts of power, enough to supply approximately one million homes for 60 years, while occupying just a fraction of the footprint of conventional nuclear facilities.

Tufan Erginbilgic, Rolls-Royce’s chief executive, has been unequivocal about the company’s nuclear ambitions. “There is no private company in the world with the nuclear capability we have,” he stated in a recent interview. “If we are not market leader globally, we did something wrong.” This confidence stems from decades of experience developing propulsion systems for Britain’s nuclear submarine fleet—expertise that Rolls-Royce is now adapting for civilian power generation.

Strategic Government Partnerships

Rolls-Royce’s nuclear market leadership strategy has gained significant momentum through key government partnerships. In June 2025, the UK government selected Rolls-Royce SMR as the preferred bidder to develop small modular reactors in partnership with Great British Energy – Nuclear (formerly Great British Nuclear). This landmark decision marks what government officials are calling “a new golden age of nuclear in the UK.”

The UK government has pledged over £2.5 billion for the overall small modular reactor program, with the first units expected to connect to the grid in the mid-2030s. Beyond the UK, Rolls-Royce has secured interest from countries including the Czech Republic, Sweden, and several Middle Eastern nations, positioning the company for global nuclear market leadership.

Environmental and Economic Benefits

The environmental benefits of Rolls-Royce’s SMR technology are substantial. Nuclear power produces minimal greenhouse gas emissions during operation, making it a crucial component in the transition to net-zero carbon economies. Each SMR could displace approximately 20 million tonnes of CO2 over its lifetime compared to fossil fuel alternatives.

Economically, the SMR program promises significant returns. With each unit priced at approximately £2.2 billion, Rolls-Royce is targeting what Erginbilgic describes as “a $1 trillion-plus market” with projections of 400 SMRs installed worldwide by 2050. The company estimates that the program could support up to 3,000 high-skilled jobs at peak construction, with thousands more throughout the supply chain.

Market Leadership Strategy

Rolls-Royce’s nuclear market leadership ambitions are bold but grounded in strategic advantages. The company’s decades of experience with naval nuclear propulsion systems provides a foundation that few competitors can match. This expertise, combined with the UK’s robust nuclear regulatory framework, gives Rolls-Royce approximately 18 months’ head start over competitors in the global SMR race, according to Erginbilgic.

Competitive Advantages

Rolls-Royce’s Nuclear Advantages

- 60+ years of nuclear engineering expertise from submarine propulsion systems

- Standardised modular design allowing factory production rather than custom on-site construction

- Strong government backing and regulatory approval pathway

- Established supply chain relationships and manufacturing capabilities

- Brand reputation for engineering excellence and reliability

Market Challenges

- Competing SMR designs from global competitors like GE Hitachi and NuScale

- Public perception concerns about nuclear energy

- Regulatory approval timelines in international markets

- High initial capital costs compared to some renewable alternatives

- Need to demonstrate commercial viability at scale

Financial Strategy and Market Valuation

Rolls-Royce’s nuclear pivot has already delivered remarkable financial results. Under Erginbilgic’s leadership since January 2023, the company’s shares have risen tenfold, from 93p to approximately £10.82. This dramatic increase has propelled Rolls-Royce past several corporate giants in market capitalization, including BP, BAE Systems, and Barclays.

The company’s ultimate ambition is to nearly double its current market capitalization of £92 billion to overtake AstraZeneca (valued at approximately £172 billion) as the UK’s largest company by market value. This would require surpassing several other corporate giants, including HSBC (£163 billion), Shell (£155 billion), and Unilever (£110 billion).

Challenges on the Path to Nuclear Market Leadership

Despite its strong position, Rolls-Royce faces several significant challenges in its quest for nuclear market leadership. Regulatory hurdles remain a primary concern, even with the UK government’s recent pledge to streamline the approval process for nuclear facilities. The company must navigate complex regulatory frameworks not just in Britain but in every market where it hopes to deploy its SMR technology.

Public perception of nuclear energy continues to be mixed in many countries. While support has grown due to climate change concerns and energy security issues, lingering anxieties about safety, waste management, and potential accidents remain. Rolls-Royce will need to invest significantly in public education and stakeholder engagement to build the social license necessary for widespread SMR deployment.

What are the main regulatory challenges for Rolls-Royce’s SMR deployment?

Rolls-Royce faces a multi-layered regulatory approval process that includes design assessment by nuclear regulators, site licensing, environmental permits, and planning permissions. While the UK government has pledged to streamline these processes, international deployment will require navigating different regulatory frameworks in each target market. The company must demonstrate safety, security, and waste management protocols that meet or exceed local requirements in every jurisdiction.

How is Rolls-Royce addressing public concerns about nuclear energy?

Rolls-Royce is implementing a comprehensive stakeholder engagement strategy that emphasizes the safety features of SMR technology, its role in climate change mitigation, and energy security benefits. The company is highlighting the inherent safety advantages of its design, including passive cooling systems and smaller radioactive inventories compared to traditional nuclear plants. Additionally, Rolls-Royce is partnering with educational institutions and industry groups to improve public understanding of modern nuclear technology.

Technological risks also persist. While Rolls-Royce has extensive experience with nuclear propulsion systems, scaling and adapting this technology for commercial power generation presents unique challenges. The company must demonstrate that its SMRs can be built on schedule and within budget—something that has proven difficult for many nuclear projects historically.

Future Outlook: Redefining Energy Markets

Looking ahead, Rolls-Royce’s nuclear market leadership strategy positions the company to play a pivotal role in the global energy transition. The International Energy Agency projects that the global SMR market could reach nearly £500 billion by 2050, representing a massive opportunity for early movers like Rolls-Royce.

One particularly promising growth driver is the increasing power demand from data centers that will facilitate mass adoption of artificial intelligence. Erginbilgic has highlighted this as a key market opportunity, noting that SMRs provide the reliable, high-capacity power needed for these energy-intensive facilities while maintaining low carbon emissions.

The scalability of SMR technology is another significant advantage. Unlike traditional nuclear plants that require massive upfront investment, SMRs can be deployed incrementally as demand grows. This flexibility makes them attractive for a wide range of applications, from powering remote communities to supporting industrial processes that require reliable, carbon-free heat and electricity.

Alignment with global net-zero targets further strengthens Rolls-Royce’s position. As countries worldwide commit to decarbonization, nuclear power—and particularly flexible, scalable SMR technology—is increasingly recognized as an essential component of a balanced energy portfolio. The UK government’s commitment to the “biggest nuclear rollout for a generation” reflects this growing recognition of nuclear’s role in achieving climate goals.

| Deployment Phase | Timeline | Expected Capacity | Target Markets | Strategic Focus |

| Initial UK Deployment | 2031-2035 | 2-3 GW | United Kingdom | Proving technology and establishing supply chain |

| European Expansion | 2033-2040 | 10-15 GW | Czech Republic, Sweden, Poland | Scaling production and reducing costs |

| Global Rollout | 2035-2050 | 50+ GW | Middle East, Asia, North America | Market leadership and technology evolution |

Reshaping the Energy Sector

Rolls-Royce’s ambitious push into nuclear energy represents more than just a corporate pivot—it signals a potential reshaping of the global energy landscape. By leveraging its deep nuclear expertise and first-mover advantage in SMR technology, the company is positioning itself to become not just a leader in this emerging market but potentially the UK’s most valuable company.

The path forward contains both significant opportunities and substantial challenges. Regulatory hurdles, public perception issues, and technological risks must all be navigated successfully. However, with strong government backing, growing recognition of nuclear’s role in decarbonization, and increasing power demands from emerging technologies like AI, the conditions appear favorable for Rolls-Royce’s nuclear market leadership ambitions.

As Erginbilgic noted, “We are chasing a $1 trillion-plus market in SMRs.” For investors, industry partners, and energy stakeholders, Rolls-Royce’s strategic leap into nuclear energy bears watching closely—it may well define the future of both the company and the broader energy transition.

For more articles on Business, please follow the link.