Latest Trends in UK Personal Finance

The personal finance landscape in the UK continues to evolve rapidly, influenced by technological advancements, economic conditions, and changing consumer behaviours. Understanding these trends can help you make more informed financial decisions and stay ahead of the curve.

The Rise of Open Banking and Financial Apps

Open Banking has revolutionised how UK consumers interact with their finances. According to the Open Banking Implementation Entity, over 6 million UK consumers and businesses now use Open Banking-enabled products. This technology allows secure sharing of financial data between authorised providers, enabling a new generation of financial apps that offer more personalised services.

Financial apps now go beyond simple account aggregation to provide AI-driven insights, automated savings, and investment recommendations based on your spending patterns and financial goals. Apps like Monzo, Starling, and Revolut continue to gain market share, with traditional banks racing to catch up with their digital offerings.

Sustainable and Ethical Investing

Environmental, Social, and Governance (ESG) investing has seen remarkable growth in the UK. According to the Investment Association, ESG fund assets reached £89 billion in 2023, a 66% increase from 2021. This trend reflects growing consumer awareness about the impact of their investments and a desire to align financial decisions with personal values.

Many UK investment platforms now offer dedicated ESG options, making it easier for everyday investors to build portfolios that consider environmental and social factors alongside financial returns. This shift is particularly pronounced among younger investors, with 71% of millennials prioritising ESG factors in their investment decisions.

Cost-of-Living Crisis Response Strategies

The ongoing cost-of-living challenges have prompted significant changes in how UK residents approach their finances. According to the Office for National Statistics, 77% of adults reported being somewhat or very worried about rising costs in 2025.

This has led to the emergence of specialised budgeting tools focused on expense reduction, energy cost management, and grocery price comparison. Additionally, there’s been increased interest in side hustles and passive income streams, with 34% of UK adults reporting they’ve started some form of additional income-generating activity in the past year.

Financial education resources have also seen a surge in popularity, with platforms offering guidance on navigating inflation and making the most of available government support programs.

Digital-First Banking and Cashless Society Acceleration

The UK continues its march toward becoming a predominantly cashless society, with digital payment methods increasingly becoming the norm.

The continued growth of digital-only banks and financial services has accompanied this shift. Traditional banks have responded by enhancing their digital offerings and, in some cases, reducing their physical branch networks. This trend emphasises the importance of digital financial literacy and having the right tools to manage your money in an increasingly online environment.

Essential Tools for Modern Financial Management

Having the right financial tools at your disposal can make a significant difference in how effectively you manage your money. Here are some of the most useful and popular financial tools currently available to UK residents.

Plum

Plum uses AI to analyze your spending patterns and automatically set aside money you can afford to save, making it ideal for those who struggle with consistent saving habits.

Key Features:

- Automated savings based on spending analysis

- Investment options including ISAs

- Bill switching service to reduce expenses

- Interest pockets for different saving goals

- FSCS protection on eligible deposits

Pros

- Effortless saving automation

- Easy to use interface

- Free basic plan available

Cons

- Investment features require premium

- Limited budgeting capabilities

- Some banks not supported

PensionBee

PensionBee helps you consolidate and manage your pensions in one place, making retirement planning simpler and more transparent.

Key Features:

- Combine multiple pension pots

- Track pension performance

- Make one-off or regular contributions

- Choose from different investment plans

- Retirement planning calculator

Pros

- Simplifies pension management

- Transparent fee structure

- User-friendly mobile app

Cons

- Not all pension types can be transferred

- Limited investment options

- Fees may be higher than some alternatives

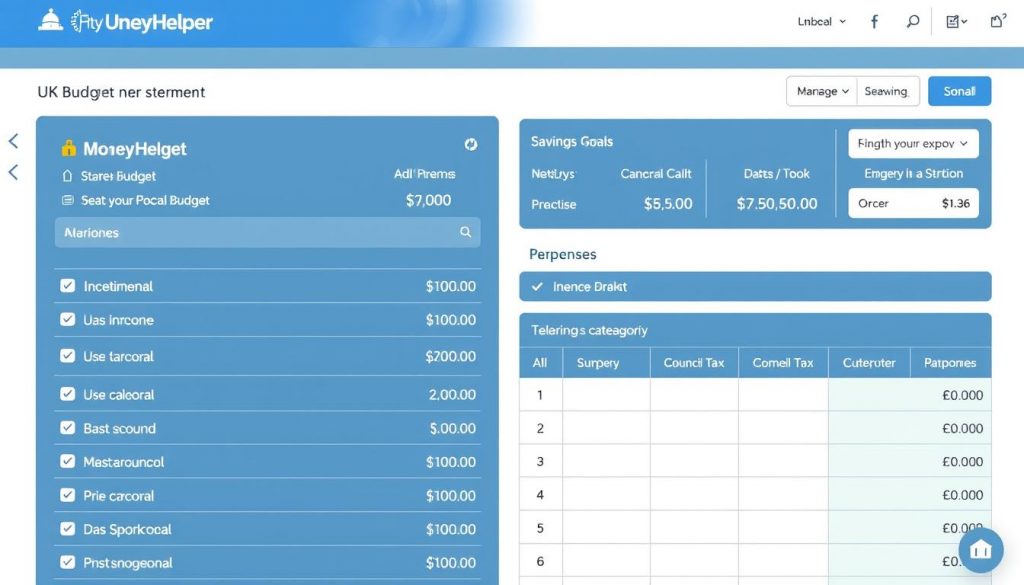

MoneyHelper Budget Planner

This free government-backed tool from the Money and Pensions Service helps you create a detailed budget and identify areas where you can save money.

Key Features:

- Comprehensive UK-specific budget categories

- Detailed breakdown of income and expenses

- Personalized tips based on your financial situation

- Option to save or download your budget

- No registration required

Pros

- Completely free to use

- Trustworthy government-backed service

- Detailed UK-specific categories

Cons

- No automatic bank connection

- Basic interface compared to apps

- Manual data entry required

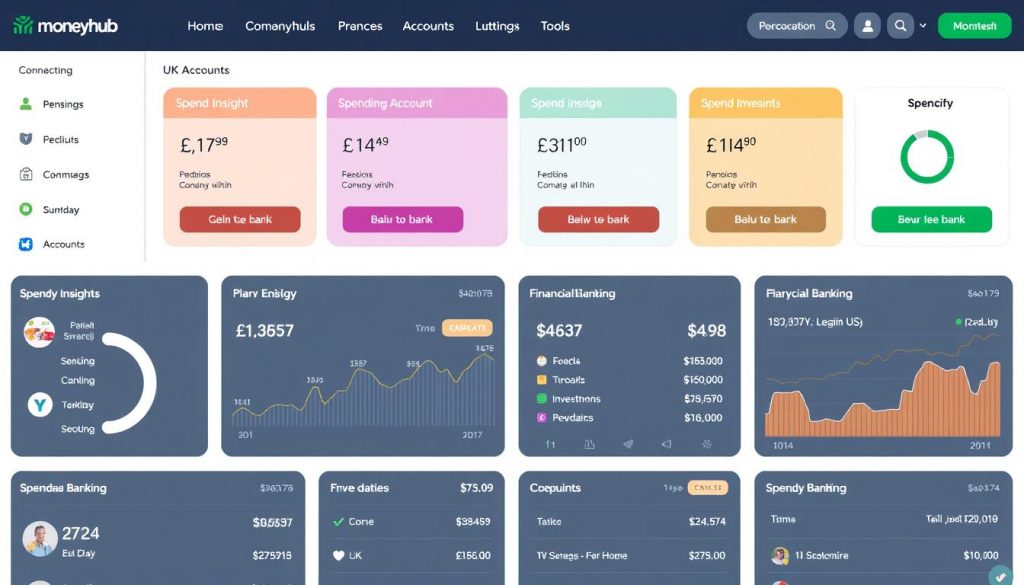

Moneyhub

Moneyhub offers a comprehensive financial management platform that connects all your accounts, including investments and pensions, for a complete view of your finances.

Key Features:

- Connect bank accounts, credit cards, investments, and pensions

- Advanced spending categorization and insights

- Financial planning tools

- Spending alerts and nudges

- Open Banking compliant

Pros

- Comprehensive financial overview

- Strong security features

- Excellent pension tracking

Cons

- Subscription required

- More complex than some alternatives

- Some features may be overwhelming

Snoop

Snoop uses Open Banking to analyze your spending and find ways to save money, from identifying better deals to spotting subscriptions you might want to cancel.

Key Features:

- Money-saving insights based on spending patterns

- Bill monitoring and better deal suggestions

- Subscription tracking

- Personalized offers and cashback opportunities

- Regular “money-saving missions”

Pros

- Free to use

- Actionable money-saving tips

- Simple, intuitive interface

Cons

- Limited budgeting features

- Some banks not yet supported

- Occasional irrelevant suggestions

How to Choose the Right Financial Tools

When selecting financial tools, consider your specific needs and goals:

- For budgeting beginners: Start with MoneyHelper Budget Planner or Plum

- For comprehensive money management: Money Dashboard or Moneyhub

- For saving automation: Plum or Chip

- For pension management: PensionBee or Moneyhub

- For finding savings: Snoop or Money Saving Expert

Most importantly, choose tools that you’ll actually use consistently. The best financial tool is one that fits seamlessly into your life and helps you develop better money habits.

Practical Tips to Stay Ahead

Beyond understanding trends and using the right tools, implementing practical strategies can help you maintain financial resilience in today’s changing economic landscape. Here are some actionable tips to help you stay ahead:

Automate Your Finances

Automation is one of the most powerful tools for financial success. Set up automatic transfers to savings accounts, investment accounts, and pension contributions to ensure consistency. According to behavioral economics research, automation removes the psychological barriers to saving and investing.

- Schedule transfers to savings on payday

- Set up direct debits for regular bills

- Use round-up features in apps like Monzo or Starling

- Automate pension contributions above the minimum

- Set calendar reminders for financial reviews

Regularly Review Your Pension

With retirement ages increasing and pension rules evolving, staying on top of your pension is crucial. The Department for Work and Pensions recommends reviewing your pension at least annually.

- Check your State Pension forecast on gov.uk

- Review workplace pension performance

- Consider consolidating multiple pension pots

- Assess whether your contributions are sufficient

- Review your pension investment strategy

Tools like PensionBee or the government’s Pension Tracing Service can help you locate and manage forgotten pensions.

Check Your State Pension

Use the government’s free service to get a forecast of your State Pension and see if you can increase it.

Stay Informed About Tax Changes

The UK tax system undergoes regular changes that can significantly impact your finances. The 2024 changes to ISA rules, for example, offer new opportunities for tax-efficient saving and investing.

- Maximise ISA allowances (£20,000 for 2024/25)

- Understand the new ISA flexibility rules

- Review your tax code regularly

- Consider salary sacrifice for pension contributions

- Stay informed about Capital Gains Tax allowances

Embrace Digital Financial Education

Financial literacy is increasingly important as financial products become more complex. Fortunately, there are many free resources available to UK residents:

- MoneyHelper website for impartial guidance

- Open University’s free financial courses

- Financial podcasts like “Money to the Masses”

- YouTube channels focused on UK personal finance

- Financial wellbeing programs offered by employers

Diversify Income Streams

With economic uncertainty, having multiple income sources provides financial resilience. The gig economy and digital platforms have made this more accessible than ever.

- Explore flexible side hustles

- Consider dividend-paying investments

- Look into peer-to-peer lending platforms

- Monetise skills through freelance platforms

- Explore passive income opportunities

According to a recent survey by Henley Business School, about 25% of UK adults now have some form of side hustle, contributing an average of £10,000 per year to the UK economy.

Regularly Benchmark Financial Products

Loyalty rarely pays when it comes to financial products. Use comparison tools and switching services to ensure you’re getting the best deals:

- Compare savings rates at least twice yearly

- Review mortgage deals 3-6 months before fixed terms end

- Switch energy providers when better deals emerge

- Compare insurance policies annually

- Review investment platform fees

Tools like Snoop and Money Saving Expert can automatically alert you when better deals are available.

Frequently Asked Questions

How often should I review my personal finances?

Financial experts recommend a comprehensive review of your finances quarterly, with a more detailed annual review. However, you should check your accounts weekly for any unusual transactions and monitor your budget monthly. Set calendar reminders for these reviews to ensure consistency.

Are financial apps safe to use?

Reputable financial apps in the UK are generally safe, especially those regulated by the Financial Conduct Authority (FCA). Look for apps that use bank-level encryption, two-factor authentication, and are Open Banking compliant. Always check reviews and the company’s security practices before sharing your financial information.

What’s the best way to start investing in the UK with limited funds?

Consider starting with a Stocks and Shares ISA through a low-cost platform like Vanguard or Trading 212. Begin with index funds or ETFs that provide instant diversification with minimal investment (some platforms allow starting with as little as £1). Regular small contributions can build up significantly over time thanks to compound growth.

How can I improve my credit score in the UK?

To improve your UK credit score: ensure you’re on the electoral register, pay bills on time, keep credit utilization below 30%, avoid multiple credit applications in a short period, check your credit report for errors, and consider using a credit-building card responsibly. Services like ClearScore or Credit Karma can help you monitor your score for free.

Conclusion

Staying ahead in personal finance requires a combination of awareness, the right tools, and consistent action. By understanding the latest trends in UK personal finance — from Open Banking and sustainable investing to digital banking and cost-of-living strategies—you can position yourself to make better financial decisions.

The financial tools highlighted in this guide can help simplify money management, automate good financial habits, and provide insights that might otherwise be missed. Whether you’re focused on budgeting, saving, investing, or planning for retirement, there are tools available to support your specific goals.

Most importantly, implementing practical strategies like automating your finances, regularly reviewing your pension, staying informed about tax changes, and continuing your financial education will help build long-term financial resilience.

In today’s rapidly changing financial landscape, those who stay informed and take advantage of the available tools and resources will be best positioned to achieve their financial goals and navigate whatever economic challenges lie ahead.